Which FAFSA should I complete?

Note: We will continue to update the FAQs as additional information from the Federal Student Aid Program is provided.

Getting Started

Our Offices are open Monday - Friday from 8:00am - 5:00pm

·You can Contact Us with an expected response to be within 5 business days. When emailing our office, you must use your CSN email and include your NSHE ID (student ID number)

· For general information, our call center is available at 702-651-4303 during normal business hours

· Limited Virtual Meetings using MS Teams are available from our main page.

Students should start by completing the Free Application for Federal Student Aid (FAFSA) at studentaid.gov. CSN’s Federal FAFSA school code is 010362.

In general, CSN will receive your application 3-5 business days after submission.

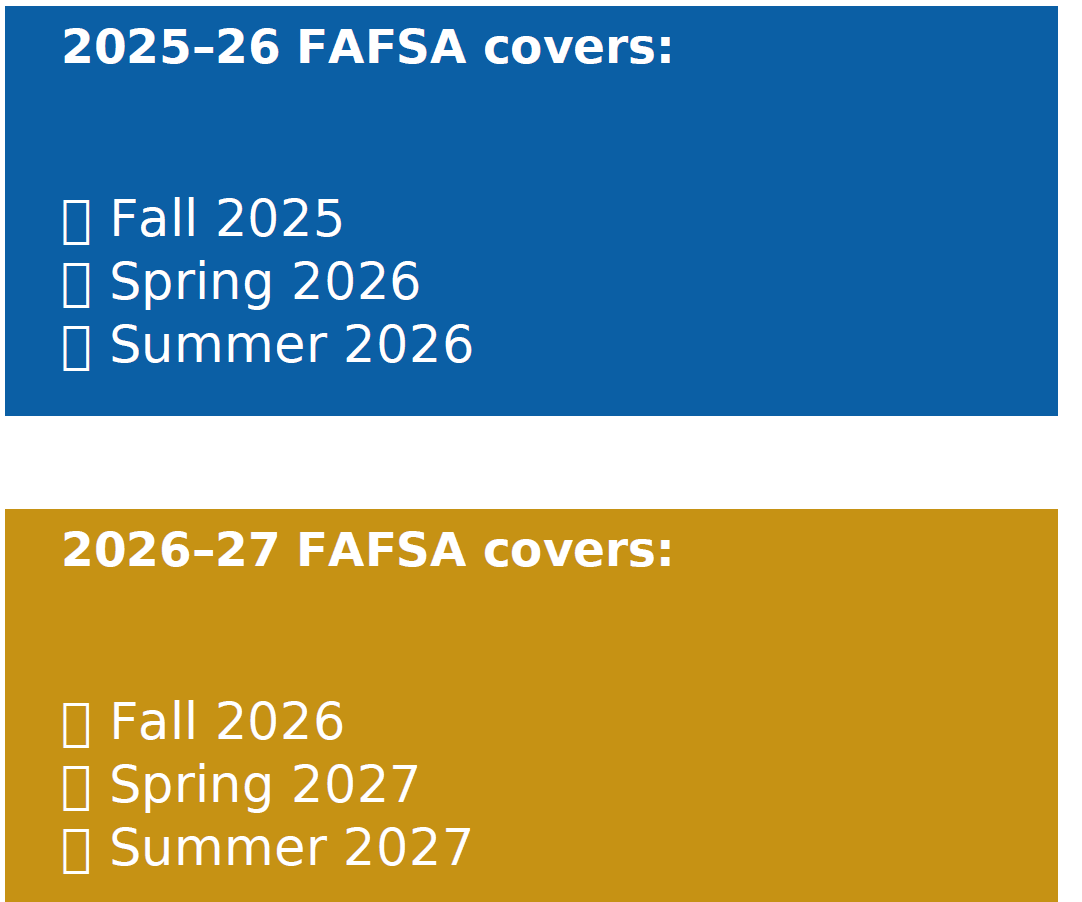

The Free Application for Federal Student Aid (FAFSA) covers three semesters, beginning with the fall term, followed by the spring term, and ending with the summer term. The FAFSA opens every October 1st for the upcoming academic year. CSN’s academic years begin in Fall and end the following Summer. Students are also highly encouraged to apply for scholarships. Our Scholarship page is a great starting point for those looking for additional opportunities for financial aid.

The following form can be submitted in-person or by mail but if mailed to us this form must be notarized and include a copy of the student’s valid, unexpired government-issued photo ID (FRONT and BACK copies of ID is required). Students can receive in-person notary services through financial institutions (banks & credit unions), the USPS, UPS, and Fedex. *Documents from an online notary are not acceptable.

Most forms can be submitted through our CSN portal. The link to the portal is available in the FORMS section of our FA webpage.

- Satisfactory Academic Progress Appeals

- Satisfactory Academic Progress Reinstatements

- Requests for Dependency Appeals

- Requests for Consideration of Special Circumstances

- Cost of Attendance Adjustment Requests

- Federal Direct Loan Applications (Subsidized and Unsubsidized Loans)

The following form can be submitted in-person or by mail however if mailed to us this form must be notarized and include a copy of the student’s valid, unexpired government-issued photo ID (FRONT and BACK copies of ID is required). Students can receive in-person notary services through financial institutions (banks & credit unions), the USPS, UPS, and Fedex. *Documents from an online notary are not acceptable.

The following forms can be submitted in-person, emailed or mailed to our Office of Financial Aid.

- Citizenship documents (U.S. Passport, Certificate of Naturalization, Alien Registration Card) (Does not require to be notarized)

- Federal Direct Parent PLUS Loan Application. (Does not require to be notarized)

Documentation can be mailed to:

CSN Financial Aid Office

6375 W. Charleston Blvd.

Sort Code WCD 126

Las Vegas, NV 89146

There could be several reasons your FAFSA information has not appeared in your MyCSN account.

· All (financial aid) items in your MyCSN To Do list must be completed before a student can receive a financial aid award letter.

· Please ensure that you have completed the correct academic year’s FAFSA and included CSN on the application. The 2025- 2026 FAFSA covers Fall 2025 - Summer 2026. Our school code is 010362.

· Your name, date of birth, or social security number are not matching on either the FAFSA or with CSN. If you are having issues correcting personal information on your FAFSA, please contact the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243. If your personal information is not correct at CSN, you may need to contact our Registrar’s office to update your information.

If your FAFSA indicates you are eligible for the Pell Grant.

In most cases, to be eligible for a Pell Grant, you must be enrolled in a minimum of one credit hour. The amount of Pell Grant you receive will vary depending on your enrollment intensity. Federal Pell Grant will be prorated based on the number of eligible credits you are enrolled. Full-time enrollment (12 or more credits) typically receiving the full amount, while enrollment in less than 12 credits results in a reduced award.

Other forms of financial aid.

The minimum eligible credit requirements differ based on the program. Please review each funding source listed on our website for detailed information regarding its specific minimum credit criteria. Some examples are listed below:

- Federal Direct Loans: 6 eligible credits

- Millennium Scholarship: 9 eligible credits

- Nevada Promise Scholarship: 12 eligible credits

- Federal Work Study: 6 or more credits (in most cases)

Loans can take up to four weeks to process from the date of submission. To ensure that your loan will be processed in a timely manner please monitor your MyCSN To-Do List and Communication Center. Additionally, continue to check your CSN emails should our office need any additional information from you.

You may be eligible for financial aid during the summer term if you meet the federal aid requirements. There is no need to specifically request the Pell Grant; as long as you are enrolled in eligible classes and meet the necessary criteria, you will be awarded the aid.

*Please note:

- Summer Loans require submission of a Summer Loan Request that can be found on our forms page.

Please visit the College Work-Study webpage for details of employment and eligibility criteria.

Under limited circumstances, the Financial Aid Office, may be able to re-evaluate your eligibility for financial aid for the school year.

2025-26 Free Application for Federal Student Aid (FAFSA)FAQs

The U.S. Department of Education has not made any substantial changes to the 2025-2026 FAFSA, other than further clarifying and simplifying questions which large sums of students found confusing or made mistakes on during the 2024-2025 FAFSA, such as the Special Circumstance and Unaccompanied/Homeless questions.

The 2025-2026 FAFSA was made available to all students and their contributors as of December 2024 and will remain open until June 30, 2026. However, it is important to note that it is best to complete your FAFSA sooner rather than later, in case of any delays or additional to-do items. A student’s eligibility cannot be determined until the FAFSA is completed and submitted.

Yes! CSN offers FAFSA Workshops for all students and their contributors, regardless of whether they attend CSN. For details on scheduled workshops, visit https://www.csn.edu/financial-aid/fafsa-workshop. Workshops begin at 3:00 PM and end promptly at 4:30 PM.

Parents, spouses, and students must create a federal student aid account to complete the FAFSA. The FSA ID verification process takes one to three days. Previously, contributors without a Social Security number (SSN) had to submit extra documentation for identity verification, but this requirement has been waived. Now, if selected for verification, those without an SSN will complete a simplified online attestation during account creation.

Parents without a social security number can create an FSA ID without an SSN. The FAFSA requires parents of dependent children to provide financial information but does not require their social security numbers.

If a student or parent cannot set up or access their FSA ID, they should call the Federal Student Aid Information Center at 1-800-433-3243. Alternatively, they can try the "Forgot My Username" or "Forgot My Password" options on the StudentAid.gov login page, and if that doesn’t work, contact the helpline.

If your email, SMS, or authenticator app verification fails during the FSA ID login procedure, you should utilize the backup code supplied when you set up your two-step verification; If you do not have a backup code, please contact the Federal Student Aid Information Center for assistance 1-800-433-3243

The Who's My FAFSA Parent? wizard is an online tool to help dependent students identify which parent(s) will be a required contributor on their FAFSA form.

The label for the homelessness question changed from "Student Other Circumstances" to "Student Homelessness.

If the student selects "Yes" to have their school determine their eligibility for a Direct Unsubsidized Loan only and then selects Continue." a pop-up window appears warning the student that they will not be eligible for most federal student aid.

A new page confirms if their information was not successfully matched with IRS records to request federal tax information to help complete the financial sections.

The new legislation includes the creation of a “provisional independent student” for students with unusual circumstances that either prevent them from contacting their parents or contacting their parents would pose a risk to the student (e.g., abandonment, abusive environment, estrangement).

If the student indicates they have unusual circumstances, they can complete the FAFSA without including parental information. Their FAFSA will then be processed, and their Student Aid Index (SAI) calculated. However, the student will need to follow up with the Office of Financial Aid to submit required documentation regarding the situation before any aid can be awarded.

A contributor is anyone who needs to assist a student in filling out the 2025-26 FAFSA form. This could be the student's parents, the parents' spouses, or the student's spouse. If you're not sure who counts as a parent for FAFSA purposes, review this link: https://studentaid.gov/sites/default/files/is-my-parent-a-contributor.jpg

If you or your family have experienced some financial circumstances, complete the FAFSA form first with the required information and once it is processed, see the Office of Financial Aid to receive additional special circumstance information and to submit the required documentation. If your special circumstance request is approved, there may be an adjustment that can change your eligibility for federal student aid. Special circumstances could include a significant decline in income, recent unemployment of a family member, high medical bills not covered by insurance, or other substantial changes in income or assets from what was reported on the FAFSA.

Once it’s been processed, you can make changes to correct or update the information on your FAFSA form. You should make a correction in the following situations:

- You made a mistake in what you reported on your form.

- Your form is in “Action Required” status, and you need to make a required correction such as adding a missing signature or providing consent and approval.

- You want to add or remove schools from your form.

Remember - most of the questions on the FAFSA form want to know your situation as of the day you signed and submitted your form.

We must receive your application no later than June 30, 2026. Your college must have your correct, complete information by your last day of enrollment in the 2025–26 school year.

A student is considered Dependent by the US Department of Education until one of the following applies: they are 24 years old, have dependents of their own they financially support more than 50%, are married, active in the military, or a veteran. If none of these apply to you, and you do not have an documentable extenuating circumstance that keeps you from being in any contact with your parents, you must file your FAFSA as a Dependent.

Financial Aid Awards

In most cases, aid notifications will be sent to a student’s MyCSN communication center and student email once they have successfully

1. Completed the correct year’s Free Application for Federal Student Aid (FAFSA),

2. Completed all related MyCSN “To-Do List” items,

3. Enrolled into classes leading towards their declared major

4. As well as, ensuring they are meeting all student eligibility requirements such as Satisfactory Academic Progress.

If you believe you have completed all necessary requirements but still have not received an award notification, please contact of office.

Student’s awards can be canceled for several reasons including but not limited to:

- SAP suspension,

- Lack of a declared major,

- Incomplete Verification,

- Lack of enrollment or enrollment in classes/majors that are not funded by Financial Aid,

- New information sent by the Department of Education,

- Not enrolled in enough credits to qualify for a given type of aid

- Some other unique student scenario

There are several reasons the Pell Grant may be adjusted:

- Adding or dropping classes may lead to an adjustment of your awards

- Verification resulted in a higher and/or lower SAI,

- Department of Education notification,

- Classes that are dropped or

- Enrollment in classes that do not lead towards your declared major.

- Not enrolled in enough credits to qualify for a given type of aid

*Other grants can be subject to proration or minimum enrollment requirements.

If you have any questions, please contact our office.

Financial Aid does not cover new student fees, payment plan fees, excess credit fees, or any fines incurred by the student.

The Pell Grant awards are based on students’ enrollment intensity (credits taken) on the census date. The census date is when the student’s enrollment is locked. The Pell Grant will be reviewed and adjustments will be made, if necessary, based on the student’s enrollment level. The students who enroll at the beginning of the semester and add courses after the census date should be prepared to pay for additional tuition & fee charges out of pocket.

**Please note: Pell Grant-eligible students who enroll in late-start course(s) for the first time (never before enrolled at CSN for the semester) may still qualify for the Pell Grant. The census date will be based on the date of enrollment or when CSN receives the student’s FAFSA, whichever is later.

For the Federal Pell Grant, it depends on several factors. Please see "What is a Census Date".

Federal Loans are not affected by the census date.

Under federal regulations, financial aid is available for repeated courses in the following cases:

(1) Failing a Course: If you fail a course, you can retake it and still receive financial aid until you pass. However, you must be meeting Satisfactory Academic Progress requirements

(2) Passing a Course: If you pass a course with a grade (D- or better, P, or S), you can retake it one more time. Financial aid will cover only the first retake.

| Course Example | 1st Class Attempt | 2nd Class Attempt | 3rd Class Attempt | Would the 3rd attempt be eligible for financial aid consideration? |

| Art101 | D | F | enrolled | No |

| Eng101 | F | F | enrolled | Yes |

| Math120 | F | D | enrolled | Yes |

| BIO101 | A | C | enrolled | No |

For more information, contact our Office of Financial Aid.

CSN does not participate in the Federal TEACH Grant program. CSN does offer a Federal TEACH scholarship through CSN's Early Childhood Education Program.

Disbursements

Please refer to our home page https://www.csn.edu/financial-aid for detailed information.

Yes, but you must pay out-of-pocket until your financial aid is processed and disbursed. You can contact the Cashier’s Office to discuss your payment options.

The “Finances” section of your MyCSN will show you all activity involving your balance, payments, and financial aid disbursements.

· If your aid has disbursed, you can view when and how much under “Account Activity” (found in the drop-down bar)

· If your aid has not disbursed, you can view pending amounts and the scheduled disbursement dates under “View Financial Aid.” Please make sure to view the correct aid year and term.

After the Office of Financial Aid disburses the Financial Aid award, the Cashier's Office is responsible for crediting student’s accounts and generating refunds.

Please contact the Cashier’s Office for questions regarding refunds.

Verification

CSN has partnered with ProEd. Students' whose FAFSA have been selected for the V1 or V5 verification processes by the Department of Education will receive notifications to complete verification from ProEd.

Loans

Federal Loan update requests take up to six (6) weeks to process. At the beginning of a semester, it might take longer to process as there are more Federal Loan Request forms being submitted.

If we are within three weeks of the semester beginning and you have completed your MPN and Entrance Counseling at least one week ago, please contact the Financial Aid Office to further research your account.

Please keep the below information in consideration when completing the MPN or Entrance Counseling.

For the MPN: Once the Federal government approves the request (originated), the MPN should be automatically uploaded onto your account. Be sure that you have successfully completed and submitted the correct MPN for the right institution and loan type.

For Counseling: (1) list CSN on the counseling, (2) ensure that you have completed the Entrance Counseling for undergraduate students - there is an option to select graduate students AND some students have completed the Financial Awareness counseling instead of the Entrance Counseling, and (3) have successfully submitted the counseling session.

Log into your MyCSN and look for the accept/decline link. This is located in the "Finances" section. Click on the link for the current aid year and it will take you to your award page. You can accept, decline, or reduce the amount of the federal loan offer.

All loans have a 30-day delay period (from your course start date) in accordance with the U.S. Department of Education guidelines. Loans will not disburse if you are under the required 6 eligible credit minimum or there are unresolved issues requiring attention from the Office of Financial Aid, other CSN departments, NSHE, or the U.S. Department of Education.

CSN should receive Entrance Loan Counseling within 48 hours. The Master Promissory Note will show as received when a loan is originated (requested from the Department of Education). Please refer to question two (2) in this loan FAQ for more information.

In general, 4 to 6 weeks. However, our office does not begin certifying loans until closer to the semester start date, even if you submitted a request months prior. In order to ensure you keep your classes, please contact the Cashier's Office for payment options. The Financial Aid Office will NOT hold your classes.

Yes. Students will need to visit the Office of Financial Aid and submit a federal loan update request form. If there is an external reason for the federal loan cancellation, CSN will inform the student.

Yes. If students have not accepted the federal loans offered on their MyCSN, please go to the accept/decline hyperlink on the MyCSN and select the appropriate aid year. Students can change their loan amounts if they have not yet accepted the award.

For students who have already accepted their awards, please visit a Financial Aid Office and complete the "Change Request" form. If the loan has already been disbursed and it is MORE THAN 120 DAYS, you will need to discuss this with your lender. Go to https://studentaid.gov/ to find out who your lender is and how to contact them.

Students are referred to the National Clearinghouse, which is located on the CSN website. The National Clearinghouse will verify the enrollment status of the student and forward the information to the lender.

Students who need to complete the Loan Entrance Counseling, Financial Awareness, and/or the MPN should go to: https://studentaid.gov/

Loan Repayment, Delinquency, and Default

Loan repayment typically begins six months after you graduate, leave school, or drop below half-time enrollment. This is called your grace period. You’ll receive information from your loan servicer about when your first payment is due and how much you’ll owe. Please be advised that if you have previously exhausted your grace period, you will no longer be eligible to receive an additional grace period. Note that for most loans, interest accrues during your grace period. You can access your federal student loan information by logging into studentaid.gov.

Contact your loan servicer immediately. You might be able to switch to a repayment plan that lowers your monthly payments or check if you're eligible for a postponement.

Avoiding payments can hurt your credit and lead to default, for additional information click here https://studentaid.gov/manage-loans/repayment#

A student loan becomes delinquent the day after missed payment and remains so until repaid or arrangements are made. Delinquency for 90+ days is reported to credit bureaus, harming your credit.

Continued delinquency may lead to default with serious consequences. If you've missed a payment or are financially struggling, contact your loan servicer immediately to discuss options and prevent default. Learn more about how to avoid default. You can also call 1-800-621-3115.

A federal student loan goes into default after 270 days of missed payments. Consequences include:

- Loss of federal financial aid eligibility

- Wage and tax refund garnishment

- Damage to your credit

- Collection costs and legal action

But you have options to recover. Contact your loan servicer to learn about loan rehabilitation or loan consolidation to get back on track. You can also call 1-800-621-3115.

Withdrawals / SAP / Past Due Balances

If you did not receive enough financial aid funding to cover what you originally owed, the remaining balance must be paid out-of-pocket.

If you were initially disbursed funds that covered your semester balance but now see a balance you previously did not owe, then you should contact the financial aid office for the most accurate information. There are several reasons this may occur including withdrawing from classes.

If you withdraw from all your courses, you will be subject to the Return of Title IV (R2T4) calculation. This may require you to repay a portion of the financial aid that was originally received. If you withdraw from some or all of your courses, you may be subject to the Return of Title IV (R2T4) calculation.

Withdrawing from courses has major implications on a student’s academic success and their financial aid eligibility. In addition to a possible R2T4 calculation, students must also ensure they meet Satisfactory Academic Progress (SAP) to be eligible for financial aid. It is strongly suggested that students contact our office prior to any withdrawal.

Depending on your situation, you may be subject to the Return of Title IV (R2T4) calculation which may require you to repay a portion of the financial aid originally received. Additionally, future financial aid may be affected if you do not meet CSN’s Satisfactory Academic Progress Policy.

Satisfactory Academic Progress (SAP) is the term used to define successful completion of coursework to maintain eligibility for financial aid. An in-depth explanation of the requirements and policy can be found on our SAP page.

SAP Appeals are submitted digitally through GoCSN portal.

The form is listed on our Forms Page. The forms are available 30 days before the semester through 30 days into the semester. Once that window closes, student’s can no longer submit an appeal for that term.

Important Information

- The Office of Financial Aid will NOT hold your classes pending a decision by the SAP committee.

- The decision of the SAP committee is final and cannot be appealed or re-reviewed.

SAP Appeal must be submitted online only, by using our FORMs link and clicking the Satisfactory Academic Progress (SAP) Appeal Forms.

Scholarships

If you have earned a scholarship and are wanting clarification of its terms and your eligibility you may want to contact the donor directly. If you have other questions you can reach our scholarship office here - Contact Us

Typically, external scholarships are awarded for the academic year and require the student re-apply for future consideration. However, if your scholarship was awarded for multiple academic years, we recommend you communicate with your donor to inquire if exceptions or an appeal process will be considered for future semesters.

Most questions about the Millennium Scholarship can be answered by visiting the Millennium Scholarship page

The form is available online at Nevada Promise Scholarship Appeal. Please note that the form is used by the College of Southern Nevada (CSN) to review for eligibility for the Promise Scholarship. CSN cannot waive or change the statutory requirements set by the Nevada Legislature however, if you believe you met the requirements or have extenuating circumstances, please complete the appeals form with additional required documentation.

To secure your eligibility, please ensure that you continue to follow the guidance provided by the CSN Promise Office found on the Promise Scholarship page in addition to previous communications received from their office.

Many new applicants may have received an email notification informing them of failing NPS eligibility requirements. If any of the following cases apply to you, this communication may be the result of a data mismatch and may not reflect your actual eligibility status.

- If you are a new applicant for the academic year who has not contacted the CSN NPS Office previously to update their office with your NSHE ID, please Contact Us via email and include within your message your current High School ID, NSHE ID, and first and last name.

- If you are a new applicant who has completed the New Student Orientation and experienced technical difficulties obtaining completion confirmation, CSN First Year Experience may have time stamped the completion of your orientation in their computer records. After reviewing their contact information here: https://www.csn.edu/fye request and include any corroborating correspondence from their office in your appeal. Your Nevada Promise Scholarship Appeal must be submitted via email. Please Contact Us for an email address to submit the documents. The appeal must be submitted by the designated deadline for the term. Please contact us to confirm the specific deadline.

- Lastly, if you were notified that a FAFSA application was not received on your behalf but certify that the application was completed prior to March 1, please Contact Us for further guidance towards resolving your NPS eligibility as soon as possible.

VETS FAQ's

Beneficiaries who are required to have a resident course to qualify for resident housing should go to the CSN VETS Center website to review the requirements if courses which are considered a resident (converted and covered under COVID legislation).

Students who have used benefits before at CSN can submit their claim using the “submit online claim” on the CSN VETS page. If you are claiming benefits for the first time at CSN, please Contact Us to obtain our New Student Packet and Checklist of documents needed to establish your benefits at CSN.