Which FAFSA should I complete?

Spring 2026 Financial Aid Disbursement – What You Need to Know

The Office of Financial Aid has updated how financial aid will be paid for Spring 2026. Please review the information below so you know what to expect.

Group 1 – Returning Students (Have Earned CSN Credits)

- Financial aid disbursement begins: January 13, 2026, for eligible students.

Group 2 & Group 3 – New Students or Students Who Have Not Earned CSN Credits by the end of the Fall 2025 term.

FA Advance (If Eligible)

- To be eligible for FA Advance, students must complete all financial aid requirements, including their To Do List, by January 7, 2026

- FA Advance begins: January 13, 2026, to help with textbooks and course materials.

- FA Advance is not additional aid; it is paid from the student’s existing financial aid.

Financial Aid Disbursement

- Disbursement begins February 4, 2026, after instructors confirm academic participation.

- Students must be enrolled in at least 6 credits to receive loan funds.

- First-time borrowers are subject to a 30-day delay; their loan disbursement will begin February 25, 2026.

Important Reminder

- Class attendance and academic participation are required for all students.

Need Help?

Contact the CSN Office of Financial Aid at finaid@csn.edu using your CSN student email or call us at 702-651-4303 or visit our Office of Financial Aid during regular business hours.

FA Advance FAQs

A Financial Aid (FA) Advance allows eligible students to use a portion of their pending financial aid to purchase required books and course materials before funds are officially disbursed.

The amount is based on the number of eligible credits you are enrolled in and is not extra money. It comes from your existing financial aid and is made available early to help you prepare for the start of the semester. This is not gift aid, it is your financial aid being used in advance for required expenses.

Financial Aid Advance is available only to Group 2 and Group 3 students and requires that you have scheduled financial aid available to cover the amount.

Students who meet all the following requirements two weeks before the official start of the semester:

- You must have no pending items on your ‘To Do List’ in MyCSN,

- Your 2025-26 financial aid pending must be more than the amount you owe CSN. Log into your MyCSN, view the "View Financial Aid" section. Click on the link for the year 2026 and scroll to the appropriate semester. Review the accepted column.

- Your aid total (including loans) must exceed your total bill plus the FA Advance amount

- Be registered for fall classes; waitlisted courses do not count.

Eligible students will receive an FA Advance notification via their pending aid by Monday, January 12th. FA ADVANCE will be repaid once your spring semester aid is disbursed (on or after February 4th).

Once your FA Advance amount has been established based on your enrollment level, no additional adjustments will be made, even if you add a class at a later date.

- Students in 12+ credit hours get $600

- Students in 9-11 credit hours get $450

- Students in 6-8 credit hours get $300

- Students in 1-5 credit hours get $150

Spring 2026 Key Dates

- January 6 – Cashier’s Payment Deadline

- January 7 – Deadline to complete financial aid file for FA Advance (Groups 2 & 3)

- January 13 – Financial Aid Disbursement (Group 1) and FA Advance (Groups 2 & 3)

- January 20 – First Day of Instruction

- February 4 – Financial Aid Disbursement (Groups 2 & 3)

If you do not receive a Financial Aid Advance or miss the deadline, you will need to purchase your textbooks and other required educational materials using cash or a credit card.

Financial aid will not be disbursed until at least three weeks into the term. To avoid delays, we strongly encourage you to finalize your eligible enrollment at least two weeks before the semester begins. Please note that there are no exceptions to the semester’s FA Advance deadline.

FAQ

Students should be actively engaged and participating in courses from the very first day of class, including web and hybrid courses. This includes class discussions, projects, reports, quizzes, tests, homework, etc.

Non-active and continual participation will lead to enrollment cancellation, reduction or loss of aid, and the student incurring the charge for the class(es) they did not attend/participate in.

Students are encouraged to communicate with their faculty instructors regarding any attendance or participation concerns.

There are no exceptions to the rules regarding delayed disbursement.

Login to your MyCSN. Under “Finances” you will find the option to “enroll into direct deposit”

We strongly advise you to open a bank account and sign up for direct deposit through MyCSN, under “Finances." For any questions or concerns, contact the Office of the Cashier at Cashiers.Office@csn.edu.

Yes. If you have pending aid that exceeds your tuition balance, your financial aid will be disbursed a few weeks into the semester. Your classes will be protected from cancellation due to non-payment, and there will be no late payment penalties. However, if you have applied for a Payment Plan, continued payments are required to avoid late fees.

Yes, a hold labeled "FA Enrollment Cancellation" is considered a positive hold, protecting your classes while aid is pending. It is temporary, added before cancellation and removed afterward. For Spring 2026, classes will be dropped starting January 6th, 2026, if you do not have an approved payment plan or pending aid, you are at risk of having your classes dropped. If using loans to help pay your tuition, you must accept the loan.

Paying for a college education can be challenging. That’s where CSN's Financial Aid Office comes in. We invite you to browse the resources on this page to learn more about the various financial aid options available to you.

Although navigating the financial aid process can seem daunting at times, we’re here to help you through it and get you started on your journey to achieve a higher education.

FATV Video

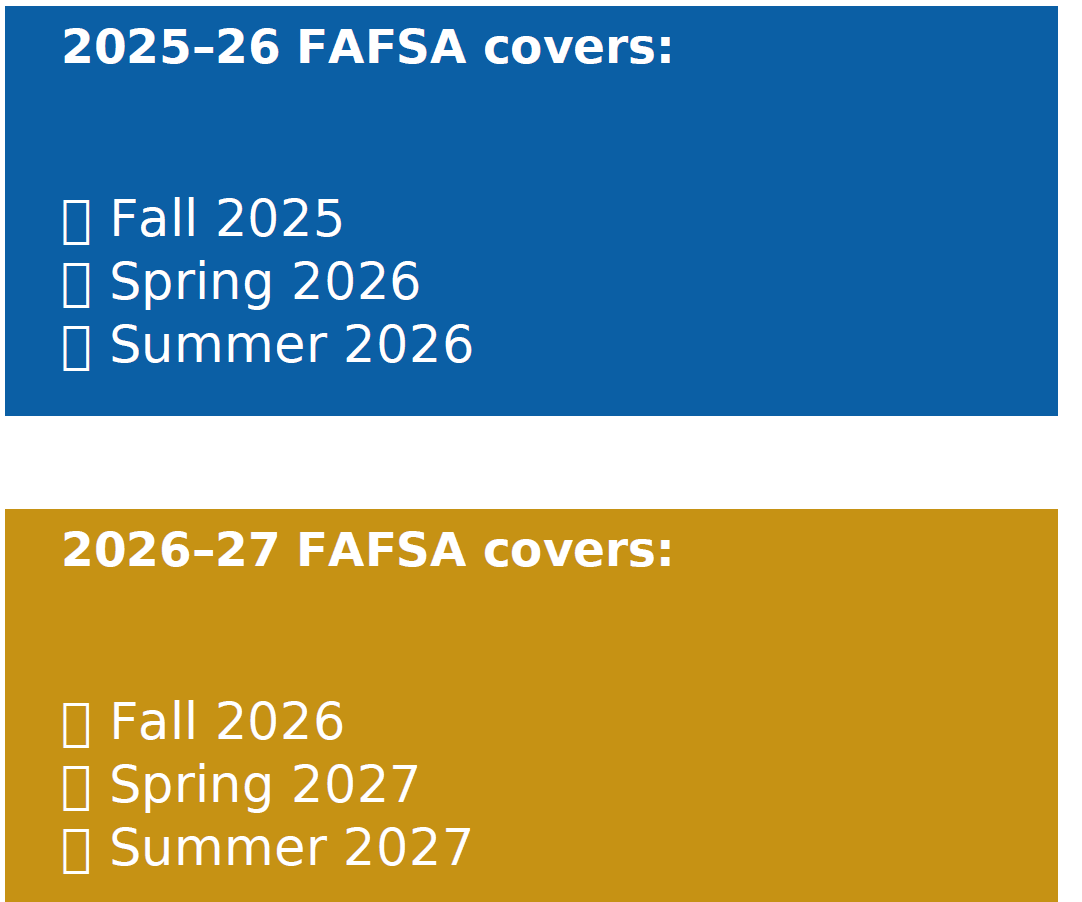

The 2026-27 Free Application for Federal Student Aid (FAFSA) is officially open!

To maximize your eligibility for federal grants, work-study, loans, and many state and institutional scholarships, submit your FAFSA as early as possible. Some aid is first-come, first-served, and submitting late may reduce or eliminate your eligibility.

Key Dates

• FAFSA opens: October 1 (annually)

• Recommended deadline for priority review: December 1

Even if you think you may not qualify, we strongly encourage you to apply. CSN uses your FAFSA to determine both financial aid and scholarship eligibility. For official federal deadlines, visit studentaid.gov.

How to Apply for Aid

Students can apply for financial aid like grants or student loans using the Free Application for Federal Student Aid (FAFSA).

CSN uses your FAFSA information to determine your federal aid eligibility. Please list CSN in the School Selection portion of the FAFSA. Our Federal School Code is 010362.

These FAFSA videos provide quick easy help with the financial aid application process.

Additional assistance can be found by - reviewing How Financial Aid Works.

Financial Aid Workshops

Our office is hosting workshops throughout the year. Click here for more information: FAFSA Workshops.

Upcoming Dates

Satisfactory Academic Progress (SAP) Appeals & SAP Reinstatements - Submission Deadline

Last day to submit SAP Appeals or SAP Reinstatements - Wednesday, February 18th, 2026

First loan disbursement for First Time Borrowers

Wednesday, February 25th, 2026

Deadline for Spring-only Loan Form Submission

Friday, April 24th, 2026

Degree Guidance Exceptions Deadline

Last day to submit Degree Guidance Exception to Academic Advising - Wednesday, April 30th, 2026

Office Updates

Maintaining Your Aid

How to Check Your Financial Aid Status

After you have successfully submitted your FAFSA you can check on the status of your financial aid in your MyCSN. To do so;

- Login to your MyCSN Student Center from the GoCSN Portal

- Check all recent messages in your Communication Center

- Address any items listed in your To-Do List

- Ensure you have no negative Holds

- Select “View Financial Aid” under Finances

- Select the Aid Year you wish to view

- Accept/Decline Awards as applicable

Contacts:

In-Person (Recommended Option)

Office Hours:

Monday – Friday 8:00 a.m. – 5:00 p.m.

CSN Financial Aid Call Center

Phone: 702-651-4303

Call Center Hours:

Monday – Friday 8:00 a.m. – 5:00 p.m.

Email Us

You may email us general questions. An expected response time for emails is 3 business days.

Note: Please include your NSHE id number

Virtual Appointments

Our office offers limited hours to assist students virtually using MS Teams.

Schedule a virtual appointment